And just like that, a wave of chatter suddenly has ensued suggesting gold’s epic run is at an end and that investors should expect prices of the metal to decline significantly in the years ahead.

Among the most prominent voices forecasting the demise of the gold bull are those at Citi. Last month, Citi’s global commodity team essentially said gold’s done all it’s going to do, and that by the end of next year investors could see the price of gold roughly 25% below present levels.

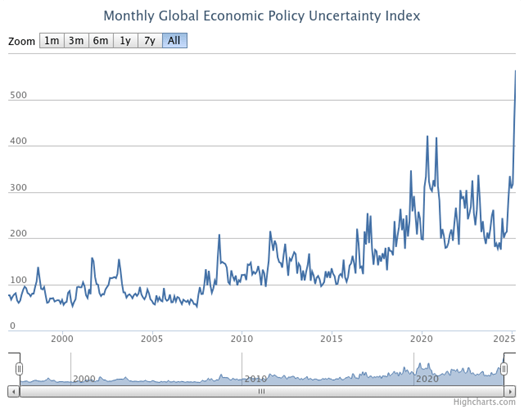

The culprit, say Citi strategists, is a peak in the demand for gold as a safe-haven asset and hedge against economic and geopolitical distress. Citi believes the risk premiums that have benefitted gold for so long – particularly those rooted in tariff-policy distress and high-profile military conflict – are in the process of abating as the feared worse case scenarios now seem unlikely to be realized.

Global Banking Giants See Gold Losing as Much as 30% From Here

Citi thinks we could see gold reach as low as $2,500 per ounce as 2026 closes out, with the bank expecting “to see the President Trump popularity and U.S. growth ‘put’ kicking in, especially as U.S. mid-terms come into focus.”

Still another prominent voice forecasting substantially lower gold prices in the years to come is that of James Steele, chief precious metals analyst at HSBC. Like the analysts at Citi, Steele has grown dismissive of concerns about debilitating global trade conflict manifesting, given President Trump’s demonstrated willingness to seek compromise in the interest of avoiding economic bloodshed.

Steele has made particular note of the simultaneous disinclination of risk assets to fold and of gold to retest the all-time high of $3,500 first reached in April as evidence that investor demand for safe-haven protection is waning.

As for his long-term outlook for the yellow metal, Steele is even more bearish than Citi, expecting to see gold drift as low as $2,350, which would translate to a 30% drop from present levels.

So…what of the prognostications that the gold bull is, indeed, on his last legs and approaching the point of exhaustion?

Are they correct?

There’s no way to know for sure right now, of course. But others who’ve been at this metals game for some time appear to be channeling Mark Twain right now, believing that rumors of the gold bull’s (impending) death have been greatly exaggerated.

Noted Metals Analyst Dismisses Big-Bank Projections of Gold Dive: “Their Default Mode Is Skepticism

One of those entirely unconvinced that gold’s run is nearing an end is Brien Lundin, editor of Gold Newsletter and host of the prestigious New Orleans Investment Conference.

During a recent appearance on the Money Metals Podcast with analyst Mike Maharrey, Lundin was unfazed by the “doom-and-gloom” outlook for gold on the part of those such as Citi and HSBC, suggesting that concession to an historically gold-averse posture is to be expected of many institutional investors.

“Their default mode is skepticism,” said Lundin. “Even when gold hit $3,500 earlier this year, they were late to the party.”

Lundin thinks those who see gold’s viability largely in terms of shorter-term drivers such as tariff distress are making a mistake, because doing so is blinding them to the more foundational influences on the metal that he and others believe keeps it viable through at least the foreseeable future.

Among those foundational influences, says Lundin, is central bank gold demand, which has been at or near record levels since 2022 and is projected to remain exceptionally vigorous through at least the end of next year. According to the World Gold Council’s recently released 2025 Central Bank Gold Reserves Survey, fully 95% of respondents said they believe global central bank gold reserves will increase over the next 12 months, while analysts at J.P. Morgan are among many who expect annual central bank gold consumption to remain around the 1,000-metric-ton pace through 2026.

“This is the first bull market in modern history driven by central bank demand,” Lundin noted during his podcast appearance. “They’re not emotional. They buy for strategic reasons and they don’t stop on corrections.”

J.P. Morgan Projects $4,000-Plus Gold Next Year Largely on Strength of Central Bank Demand

Note, however, that it’s not just metals-centric analysts such as Lundin who expect gold to continue demonstrating impressive resilience through the foreseeable future.

During a recent appearance on Bloomberg Television, Grace Peters, global head of investment strategy at J.P. Morgan, said she sees gold surpassing $4,000 within the next 12 months. And like Brien Lundin, Peters believes relentless central bank demand will underpin the achievement of that price target.

“Looking 12 months forward, north of $4,000, we think, would be a new reasonable price target for gold, with key drivers being still emerging market central banks,” Grace Peters said. “When you look at EM (emerging market) positions versus DM (developed market) central banks, there’s quite a lot of room still for EM central banks to position closer to where their DM counterparts are.”

My Take: Gold Should Continue to Thrive as Long as Its Structural Drivers Remain Intact

In my opinion, it is difficult to argue against a structural bull case for gold, even after all the metal has accomplished during what has been a run for the ages already.

The expectation that we’ll continue to see high levels of gold demand by central banks – institutions which are so price insensitive that they can keep buying the metal without regard to how expensive it becomes – clearly is a part of that structural case. But so, too, of course, are the reasons why central banks are devouring gold, including growing geopolitical risk in a deglobalizing world, concerns about dollar stability amid surging U.S. debt loads, and anxiety over heightened political risk in developed economies.

These are among the most valid and deeply rooted reasons for owning gold. And the expectations of their continued relevance mean they can and should continue to drive gold demand not only among central banks, but among sovereign wealth funds, institutional investors and even retail investors…a broad-based wave of gold demand which is likely to push the price of the metal to $4,000 and beyond in the years to come.

This post is created and published for general information purposes only. The Gold Strategist blog and Bob Yetman disclaim responsibility for any liability or loss incurred as a consequence of the use or application, either directly or indirectly, of any information presented herein. Nothing contained in this post – or any other post featured at this blog – should be construed as a solicitation or recommendation to engage in any financial transaction. You should seek the advice of a qualified professional before making any changes to your personal financial profile.