Is gold on the way to becoming a universally regarded core portfolio component – even a mainstream asset?

Among the more compelling pieces of evidence in support of that idea is the metal’s improving reliability as a long-term capital appreciation instrument, a virtue highlighted in a recent Forbes piece by Alex Shahidi, managing partner and co-CIO at Evoke Advisors.

“Since 1971, when the U.S. came off the gold standard, the precious metal has delivered strong, competitive returns,” Shahidi writes, “nearly matching global equities over the long term, with annualized returns of 8.4% compared to 9.2% for global stocks.”

Shahidi’s assessment comes on the heels of a similar conclusion drawn by the World Gold Council. In a report published earlier this year on gold’s appropriateness as a strategic long-term asset, the WGC said:

“Looking back over more-than half a century since the US gold standard collapsed in 1971, the price of gold in US dollars has increased by 8% on an annualized basis – a performance comparable with that of equities and higher than that of bonds over the same period.”

The WGC also crowed about gold’s “shining” performance through a variety of more recent time frames, noting:

“Gold has performed well over the past 1, 3, 5, 10 and 20 years, despite the strong performance of risk assets.”

Analyst: Since Millennium’s Start, Gold Has Returned 10.1% Annually vs. 5.9% for Global Equities

Of particular note is just how well gold has performed since the beginning of the millennium, something else of which Shahidi makes specific mention:

“Notably, since the turn of the millennium, gold has significantly outpaced equities, delivering 10.1% annual returns versus just 5.9% for global stocks, by my calculations. This remarkable track record highlights gold’s enduring value as an investment, especially in the modern era.”

Gold’s impressive performance numbers over the last quarter-century highlight something else: the significantly greater prominence of uncertainty on the global economic and geopolitical stage.

To be sure, gold has a multitude of impactful drivers…including consumer demand, which is an influence that’s far more relevant during robust economies; not exactly the periods during which a perceived safe-haven asset is expected to thrive.

In fact, the WGC details, consumer demand – rooted in gold’s utility to both the technology and jewelry industries – accounts for roughly 40% of the metal’s overall demand.

Still, it remains gold’s appeal as a crisis asset…an asset inherently poised to strengthen amid distress, both real and feared…that appears to be its most dynamic catalyst. And in an environment characterized by greater overall and chronic uncertainty, one might expect gold to, in turn, post better numbers over extended periods.

Coincidence? Gold’s Long-Term Performance Has Improved With the Surge in Global Uncertainty

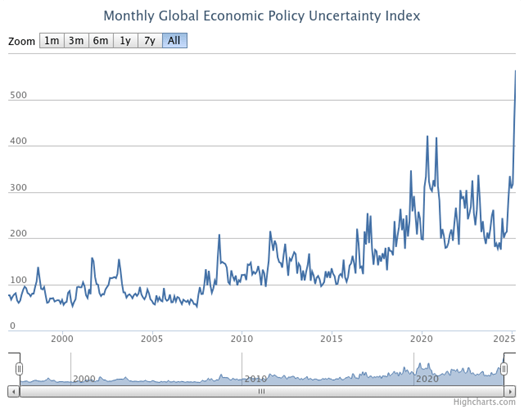

That’s exactly what it’s been doing. As Alex Shahidi points out, gold has managed to best global stocks – in terms of average annualized returns – by roughly 70% since 2001; a period, not so coincidentally, that has seen popular uncertainty metrics – including the World Uncertainty Index and Economic Policy Uncertainty Index – rise to their highest recorded levels, fueled by a seemingly endless string of profound global shocks that include:

- the 9/11 attacks;

- the global financial crisis;

- the COVID-19 pandemic;

- Europe’s largest ground war since World War II;

- and obscene levels of fiscal profligacy poised to trigger a massive global debt crisis.

Chart courtesy of Economic Policy Uncertainty

Central Banks Have Been Net Purchasers of Gold Every Year Since 2010

It is, in fact, this rising uncertainty – particularly that which threatens dollar reliability and stability – that’s largely responsible for another highly impactful source of gold demand: central banks. Central banks have been net purchasers of gold every year since 2010. And since 2022…the same year Russia saw half its global reserves frozen by the West as punishment for Moscow’s invasion of Ukraine…central bank gold demand has been at or near record levels, something Alex Shahidi references in his public embrace of the metal.

“With its surprisingly strong historical returns over the long run, high liquidity and strong central bank support, it can be a valuable portfolio tool that offers diversification, inflation protection and stability during market turmoil,” Shahidi writes, adding:

“While not a conventional holding for all investors, gold’s unique attributes and proven track record make it worth considering as part of a well-diversified investment portfolio.”

For that matter, Shahidi’s pro-gold posture is hardly “conventional” for a key person at a billion-dollar asset manager. But in the words of the immortal Bob Dylan, the times they are a-changin’. And the way in which they’re “a-changin’” suggests the possibility that uncertainty might become a permanent part of the global landscape.

Should that disconcerting eventuality come to pass, then gold may be viewed not only as a standard portfolio holding, but also as a hedge deemed so critical that those advisors who opt against owning it on behalf of their clients could one day be seen as negligent for refusing to do so.

This post is created and published for general information purposes only. The Gold Strategist blog and Bob Yetman disclaim responsibility for any liability or loss incurred as a consequence of the use or application, either directly or indirectly, of any information presented herein. Nothing contained in this post – or any other post featured at this blog – should be construed as a solicitation or recommendation to engage in any financial transaction. You should seek the advice of a qualified professional before making any changes to your personal financial profile.