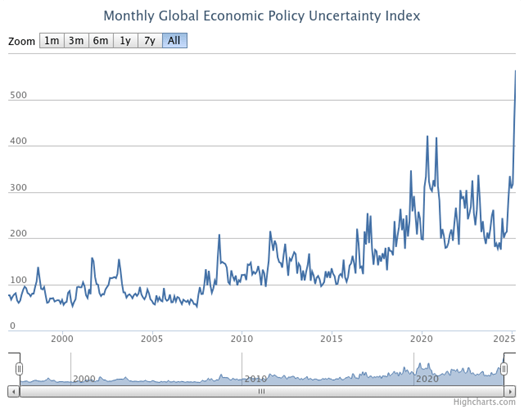

America’s gross federal debt is now more than $37 trillion. The annual budget deficit is projected to average – average – well over $2 trillion through 2035. And in just nine years, the gross federal debt is forecast to be 50% higher than current levels while debt held by the public is forecast to reach above 120% of GDP.

And in the assessment of hedge fund legend Ray Dalio, these worrisome numbers are about all that he needs to hear to believe gold…and perhaps Bitcoin…now are exceedingly critical portfolio assets.

Dalio is the founder of Bridgewater Associates, the world’s largest hedge fund, and a longtime critic of Uncle Sam’s fiscal profligacy; a profligacy the money manager thinks is poised to doom investors who refrain from adding meaningful quantities of key alternative assets to their holdings.

This past weekend, Dalio was a guest on CNBC’s Master Investor Podcast, and used the opportunity of his appearance to issue yet another warning about the nation’s unsustainable fiscal trajectory.

“It’s spending 40% more than it takes in,” Dalio said of the government, “and it can’t really cut spending because so much of it [spending] is fixed.”

In other words, warned Dalio:

“We are at the point of no return.”

America’s Fiscal Ills Put the Nation at Risk of Suffering “an Economic Heart Attack”

Dalio likened America’s distressed fiscal structure to a failing human circulatory system…and suggested the economy is likely to suffer an eventuality every bit as dire:

“The credit system is like a circulatory system that brings nutrients—buying power—to different parts of the economy. If that buying power is used to generate income, then the income services the debt, and it’s a healthy system. But when debts, debt service payments, and interest rates rise, they begin to crowd out other spending—like plaque in the circulatory system—creating a problem akin to an economic heart attack.”

And according to Dalio, it is not just the U.S. that’s facing a fiscal flatline…but all Western economies.

“Just like in the ’70s or the ’30s, they will all tend to go down together. We’ll pay attention to their relative movements, but they will all decline in value—relative not to fiat currencies, but to hard currencies. And that hard currency is gold,” Dalio said.

Gold. The 5,000-year-old medium of exchange and store of value to which all other currencies are compared. And, in the assessment of Dalio, the one true life preserver for investors he believes are destined to one day find their portfolios drowning in a sea of government debt.

It’s no secret that central banks have for years been putting a great deal of faith in gold’s potential to hedge, diversify and otherwise protect reserves. Central banks have been net purchasers of gold since the financial crisis (2010) and have been stockpiling the metal at or near record pace since 2022.

Debasement-Fighting Assets Should Make Up 15% of Portfolios, Says Dalio

Noting that gold overtook the euro earlier in 2025 to become the second-largest reserve currency, Dalio suggested that investors might do well to take a page straight from the more recent editions of the central bank handbook and allocate 15% of their portfolios to the yellow metal.

Notably, the storied money manager also raised the possibility of Bitcoin serving as a useful defense against fiscal instability. But Dalio clarified that while he owns both assets, it’s gold that he believes may serve as the more reliable hedge.

“I strongly prefer gold to Bitcoin,” Dalio clarified, “but that’s up to you.”

The overriding issue, he insisted, is making sure that one has a hedge against “the devaluation of money.”

The overwhelmingly likely prospect is that developed-market fiat currencies the world over now are in a circumstance of permanent devaluation – at least until the global economy is overcome by an explicit debt crisis. Which means any effective hedges against that condition…possibly crypto, but certainly gold…are well-positioned to thrive on a structural basis through at least the foreseeable future.

This post is created and published for general information purposes only. The Gold Strategist blog disclaims responsibility for any liability or loss incurred as a consequence of the use or application, either directly or indirectly, of any information presented herein. Nothing contained in this post – or any other post featured at this blog – should be construed as a solicitation or recommendation to engage in any financial transaction. You should seek the advice of a qualified professional before making any changes to your personal financial profile.